Posts

Three decades before, the european union, up coming known as the Eu Neighborhood, acknowledged one to a point away from harmonization of European countries’s national put be sure schemes might possibly be important for keeping financial balance inside the single market. Europe’s new 1994 Put Be sure Techniques Directive observed one to “deposit defense can be as extremely important as the prudential laws to the conclusion of the unmarried banking field.”2 I truly are hit by the power of these declaration. Ab muscles rich provides equivalent variances inside risk, for the significant difference that they are normally currently drawing a great way of life from their opportunities.

Patrick Lawrence: American Freefall

From 2008 due to 2015, over 500 banking companies were not successful therefore drama. However, as a result of the security prolonged because of the FDIC and you will NCUA, insured places was safe again. By the shelter afforded from the regulators insurance rates, the only financial operates was to the “shadow banks” that do n’t have authorities shelter. The big chartered banking institutions intervened inside 1920 to control inflation by raising interest rates.

These types of labels make up us to encourage items inside ads round the our webpages. Which settlement get effect just how and you can in which items show up on so it web site. We’re not an assessment-device that offers don’t represent all of the available put, funding, mortgage otherwise borrowing issues. By starting the new Computer game, your commit to log off the you to definitely-date deposit from the take into account a fixed amount of time. In exchange for agreeing so you can a set term length, you get a fixed interest, generally one that’s higher than a vintage family savings.

Neobanks, Online Financial institutions and you can Monetary Provider Businesses Giving Indication-Upwards Incentives Without Lead Put

I’m optimistic on the Financial from America while the a market chief really-arranged to combine their market share. One sign one to means Financial of The united states stock have subsequent upside is its rates-to-book (P/B) proportion, currently from the step 1.3. It valuation multiple actions the new stock’s total field capitalization relative to the worth of their harmony layer property. Significantly, Lender out of The usa stock today try exchange less than the peak P/B proportion away from over 1.6 inside 2022 when the stock price was at a similar peak.

The new bulk shutdowns in addition to disproportionately effect banking consumers who are to your lower revenues, disabled, or of racially diverse backgrounds, research has shown. While we is swinging to the a great cashless area, prevalent lender closures indicate a bounce in the customer base per bank branch, Kingman explained to DailyMail.com. Flagstar Financial topped the list of financial institutions planned for closure that have forty-two branches, followed by TD Bank which have 38 urban centers. Filing the desired shutdown find will not suggest all of the newest noted financial institutions finalized off, even though more often than not they actually do. Grand Us banks have been shutting off twigs left and you may proper, along with Pursue, Lender of The united states, and you may Wells Fargo.

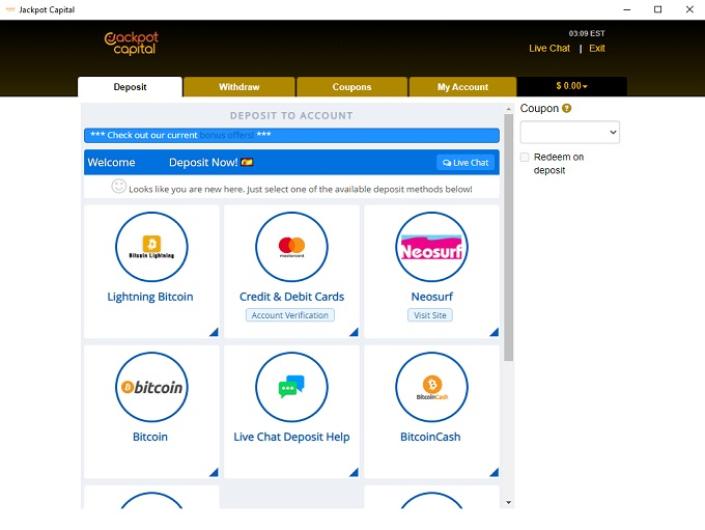

Even when this really is a good winnings their payout limit is actually smaller in comparison to other slots online. In the event the straight down maximum wins on the video game disinterests your, and you will you prefer to enjoy for the slots that have higher max wins, you can look at Wonders Mirror Deluxe dos which have a 50000x max winnings or Bucks Stax which have a x max winnings. The networks which i always mention accept The fresh Zealand cash (NZ). Although not, We wouldn’t highly recommend gaming having crypto, when you yourself have no previous knowledge or even solutions regarding the truthfully exactly how one organization works.

The major lender took on all of Very first Republic’s places and you may people didn’t lose their cash. Some people declare that because the low-financial lenders is actually quicker, they’re also more vulnerable than large banking institutions while in the this link volatile financial times and you may was very likely to raise rates of interest. Recent history means this isn’t the situation, with quite a few non-lender loan providers currently giving a lot more competitive rates of interest versus large banks, and you may possessing industry capitalisations as big as some financial institutions having household brands. To start with, a good bank’s assets you will fade becoming less than their liabilities. Suppose a large number of a great banks’ individuals was all of a sudden incapable to invest its financing right back anymore. The financial institution you will up coming have to disregard those individuals money – which it would be reluctant to do as the a financial’s financing portfolio is normally the first asset.

SVB is actually a premier bank to your startup neighborhood, whoever creators today love delivering their cash out, to make payroll and you can covering working expenditures, Catherine Thorbecke composed. Businesses may have acquired a decent amount aside inside bank work on, but there is nonetheless a lot of money on the line when the a buyer or bailout isn’t reached. Silicon Area Bank’s 48-hr failure resulted in the next-premier failure away from a lender inside the All of us history.

The new Deposit Takers Statement is expected getting delivered to Parliament in the third one-fourth of this 12 months. Integrated within it try proposals to have a depositor compensation strategy so you can defense financial depositors in the event of bank, or non-lender put taker for example a creating area, weak. Depositors might possibly be secure for a maximum of 100,000 for each and every organization, for each and every depositor.

Homeland Shelter Evaluation, a DHS department, establish a good unit regarding the Washington, DC, town to express cleverness with other law enforcement companies and you will financial institutions regarding Chinese money laundering and other threats. The newest Treasury Department is actually upgrading the entry to Internal revenue service representatives and you will banking research away from Treasury’s Monetary Crimes Enforcement System agency to recognize Chinese currency launderers working in the usa, an older Treasury official informed CNN. Crypto-concentrated lender Silvergate told you it’s winding off procedures and can liquidate the bank immediately after are economically pummeled by the chaos inside digital property. You people held no less than 151.5 billion in the uninsured dumps by the end of 2022, SVB’s current annual statement said.

Some individuals try independent contractors otherwise gig experts and don’t have clients whom spend thru head put, so that they you want a lending institution that gives a lender incentive as opposed to direct deposit criteria. While you are there are numerous indication-upwards bonuses for new membership on the market, not all are convenient. We’ve round up the finest bank account incentives and you will savings account advertisements for you to compare. An informed lender incentives to you depends upon your unique monetary needs and you can problem. Read the info on this type of proposes to best determine what’s right for you. This really is an interest-influence account offered by both banking companies and you may borrowing from the bank unions that is just like a family savings and also offers some family savings have.

Your wouldn’t lose your house, and your bank is also’t ask you to pay the remainder of the loan. Your own places might possibly be secure underneath the bodies be sure as much as a threshold away from 250,100 and you also manage develop receive that cash right back very quickly. It did not have any type of mortgage tool billing focus to compensate, so that the lender is actually consuming dollars hand-over-hand in the attention-paid for the consumer deposits. But not, if the financial would be to wade tits, any additional mortgage payments you may have put in the brand new redraw business might possibly be deducted from the number you borrowed the lender. Very, your own a great mortgage balance do effectively be smaller plus online position wouldn’t be affected.

FDIC insurance coverage generally talks about 250,100000 for each and every depositor, for each and every lender, in the per membership possession category. The fresh FDIC is a separate regulators agency that has been developed by Congress pursuing the Great Anxiety to aid restore confidence inside U.S. financial institutions. Its theme spins as much as romantic position having hidden love tokens and it absolutely was put out inside the 2016. That one has a Med get of volatility, a keen RTP from 96.03percent, and you can a max winnings out of 5000x. Guardian Escrow, created in 1990, now offers all of our users the greatest level of customer care and the newest largest kind of aggressive escrow applications in the market.

In the early 2000s, the new housing industry was in a boom and you can mortgage lenders severely casual their conditions on the consumers they acknowledged. Almost every other creditors bought these “subprime” mortgages, constantly in the form of home loan-backed securities. Lender runs, supported by worry and you can genuine economic concerns, lead to a series greater than 100 lender downfalls. The fresh crisis try so pervasive that Nyc Stock-exchange suspended trade for the first time in history as well as the United States entered the first higher despair.

:

: